2020 Capital Spending Survey: Cautious Optimism

John Sprovieri | Assembly Magazine

2020 Capital Spending Survey: Cautious Optimism

With a new presidential administration and an end to COVID in sight, manufacturers are ready to invest in their assembly lines.

Slowly but surely, U.S. manufacturing is recovering from the pandemic-related slowdown.

Each month, the Federal Reserve measures manufacturing output as a percentage of real output in a base year, currently 2012. The index for October was 99.9. In other words, U.S. manufacturers produced about 0.1 percent less in October 2020 than they did in October 2012. In comparison, the index was 87 in May. In short, we’ve made up a lot of ground in just five months.

Excluding mines and utilities, output at factories increased 1 percent from September. The gain was broad-based, with increased production of consumer goods, business equipment and construction supplies, which should bode well for the fourth quarter.

“The acceleration in manufacturing output in October suggests that, after lagging the broader recovery over the past six months, factory sector is now catching up some lost ground,” says Michael Pearce, senior U.S. economist at Capital Economics Ltd. “With inventory levels still lean, we expect production to continue rising over the coming months, even if the recovery in consumption falters.”

More good news: Since the end of the Great Recession, U.S. manufacturing jobs increased steadily, from 11.5 million in December 2009 to 12.9 million in November 2019. Then came the COVID-19 pandemic. In just five months, we lost nearly 1.4 million jobs. Fortunately, that trend began reversing in May, and the sector has recovered 54 percent of those jobs through October.

Even more good news: Manufacturers are continuing to invest in people, plants and equipment. On Oct. 14, Volkswagen announced that it has ordered more than 1,400 robots from FANUC for its assembly plants in Chattanooga, TN, and Emden, Germany. It ordered an additional 800 robots from ABB for its assembly plant in Hanover, Germany.

Volkswagen will use the robots primarily for body production and battery assembly. The three plants are being prepared to assemble electric vehicles. Beginning in 2022, VW will produce the new ID.41 compact electric SUV at the Chattanooga and Emden plants, while an electric commercial van, the ID.BUZZ2, will be assembled at Hanover.

“At Emden and Chattanooga, we are developing two of the most advanced production facilities in the automotive industry for the transformation to e-mobility,” says Christian Vollmer, VW’s manager for production and logistics. “We are investing in the latest technologies, such as digitalization and automation, for this purpose even in the present situation.”

All totaled, VW plans to invest more than $39 billion in R&D and manufacturing technology by 2024 with the goal of becoming the market leader in electric vehicles.

Other carmakers announced big investments, too. Ford has begun construction of the new Rouge Electric Vehicle Center in Dearborn, MI, where it will build the all-electric F-150 by mid-2022. General Motors plans to invest $71 million in two Ohio manufacturing facilities, including $39 million at its Toledo transmission plant and $32 million at its Defiance casting plant. The investments will enable GM to retain 240 U.S. manufacturing jobs.

In the South, Mazda and Toyota announced that they would significantly increase their investment in a soon-to-be-completed joint-venture assembly plant in Huntsville, AL. Mazda Toyota Manufacturing will invest another $830 million in the state-of-the-art factory on top of $1.6 billion that’s already been spent, bringing the total up to $2.31 billion. Production is expected to begin in early 2021, eventually ramping up to assembling 150,000 Mazda crossover vehicles and 150,000 Toyota SUVs per year. Some 600 plant employees have been hired so far, and the factory will eventually employ up to 4,000 people.

Manufacturers in other industries are also pumping money into production. The Medicom Group, a manufacturer of medical devices, announced that it is building a mask manufacturing facility with triple the square footage of an existing factory in Augusta, GA. And, GE Healthcare plans to invest $50 million in a new assembly plant in West Milwaukee, WI, to make CT scanners and other products. The facility could eventually employ more than 1,200 people.

Will investments like that continue into 2021? The results of our 25th annual Capital Equipment Spending Survey are certainly mixed, but overall, we expect a slight uptick in spending on assembly technology next year.

Tempered Growth

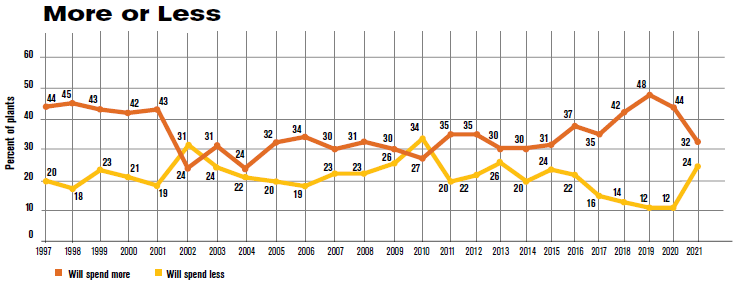

Some 32 percent of respondents will spend more on assembly technology next year than they did this year. On the one hand, that percentage has now topped 30 percent for 11 consecutive years. On the other, it’s the smallest percentage since 2015.

Conversely, 24 percent of respondents will spend less in 2021 than they did 2020, the highest percentage in five years.

Forty-four percent will spend the same as they did in 2020.

Looking at spending plans by industry, it’s clear how the COVID-19 pandemic has benefited some industries and crushed others.

Perhaps no other industry has been hit harder by the COVID-19 pandemic than the aerospace industry. Just 9 percent of aerospace assemblers expect to spend more in 2021 than they did in 2020, while 44 percent plan to spend less. Aerospace assemblers will spend, on average, $732,000 next year on new equipment, 19 percent less than in 2020.

Conversely, 44 percent of medical device manufacturers will spend more next year, while only 22 percent will spend less. Medical device manufacturers will spend, on average, $637,857 on assembly technology next year, a substantial increase from the 2020 average of $397,562.

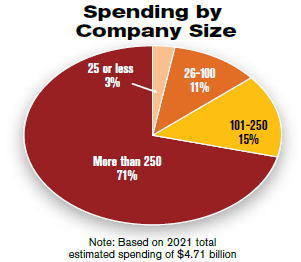

Looking at spending plans by company size, our data indicate that the pandemic has hurt smaller manufacturers more than larger ones. Some 39 percent of companies with more than 250 employees will spend more next year than they did this year, while just 17 percent will spend less. Conversely, only 25 percent of companies with fewer than 250 employees will spend more in 2021 than they did in 2020, while 32 percent will spend less.

Budget Data

Of all plants that will spend more, the median budget increase is 20 percent. Of those that plan to spend less, the median budget decrease is 25 percent.

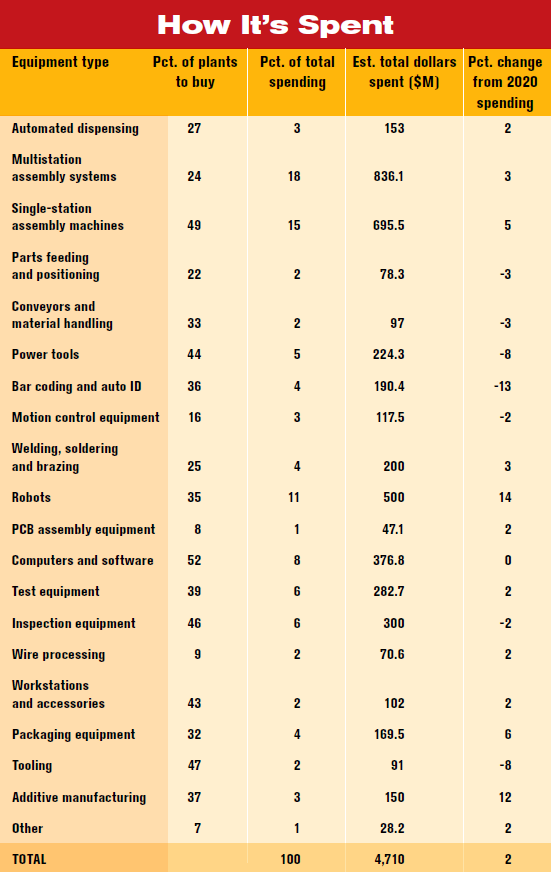

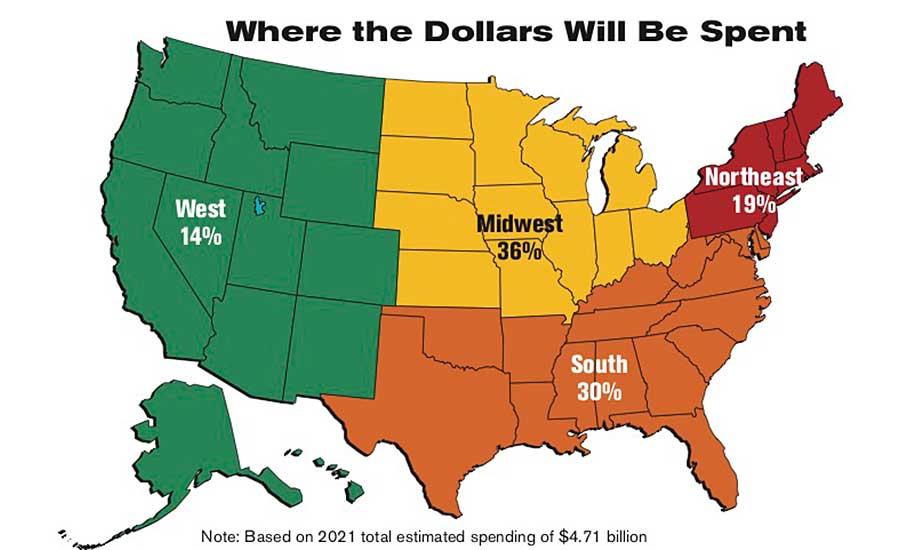

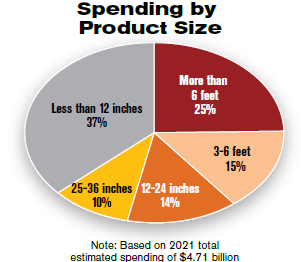

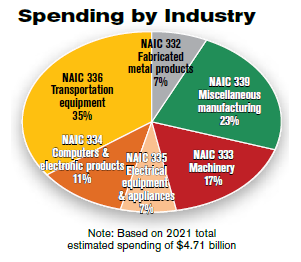

That’s not to say, however, that overall spending will increase that much. Our data indicate that U.S. assembly plants will spend $4.71 billion on new equipment in 2021, an increase of 2 percent from the $4.62 billion projected to be spent in 2020.

On average, manufacturers will spend $860,329 on assembly technology in 2021. That compares with $748,037 in 2020, and it’s the fourth highest average in survey history. The median budget total is $150,000—the same as in 2020, which was the second largest median in survey history.

“Our 2020 has been crazy,” says Rick Brookshire, director of Epson Robots. “The first quarter was good, but many customers were cautious about the economy moving forward. Then COVID hit and everything slowed down as factories closed and companies tried to figure out what to do next. COVID brought more business in some areas and heavily reduced business in others.

“Overall, we are having a good 2020—better than 2019—and we expect more of the same in 2021,” he continues. “However, not all factories are expanding or spending on automation. Many companies are just trying to keep the lights on, while others are using this slow time to retool and automate areas they haven’t looked at in the past. So, we are finding new opportunities for automation.

“It’s going to be tough going for many companies over the coming months, but those that figure out how to compete better through automation will come out of all of this in much better shape than when it started.”

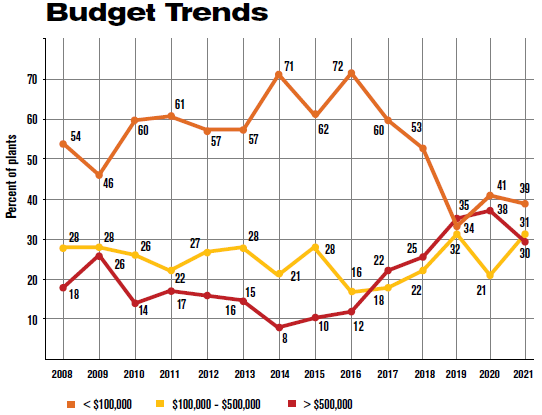

Aggregate budget data indicate a retreat in the largest budgets, but growth in midlevel spending. For example, 30 percent of plants have capital budgets of at least $500,000 in 2021, compared with 38 percent this year. But, 31 percent will spend between $100,000 and $500,000 next year, compared with 21 percent in 2020. Spending at the lower tier will hold steady: 39 percent of plants will spend less than $100,000 on assembly technology in 2021, which is about the same as this year, 41 percent.

“It has been a challenging year for manufacturers and suppliers alike,” says Milton Guerry, president of SCHUNK. “Headwinds felt in late 2019 turned into a full-on storm with the demand and supply disruptions brought on by the pandemic.

“Looking toward 2021, the manufacturing future is bright,” he continues. “The justifications for investments in automation and robotics are strong: short, secure supply lines; economic predictability and stability; and potentially friendly policies and incentives. 2021 will mark significant recovery and put manufacturing on firm ground for the future. It is a foundation that we will all rebuild together. SCHUNK’s strategy is to position our organizations, prepare our internal teams, collaborate within our manufacturing communities, and proceed confidently.”

“For 2020, our company will largely be on-plan for year-over-year growth on the top line,” adds Gene Bressler, vice president of ATC Automation, a systems integrator in Cookeville, TN.

While the transportation sector had deep pull-backs, says Bressler, both the consumer products and life sciences sectors enjoyed robust growth, some of which can be attributed to Operation Warp Speed, the public-private partnership initiated by the federal government to accelerate development, manufacturing and distribution of COVID-19 vaccines, therapeutics and diagnostics.

“With a solid backlog going into 2020, we are forecasting positive top line and bottom line growth in 2021, largely on the basis of a strong forecasted second-half recovery across all markets,” says Bressler. “A COVID-19 vaccine will play a big role in sentiment as well as normalization of travel and workplace costs.”

Getting Old

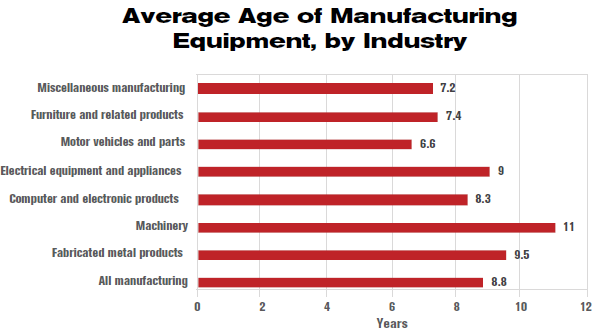

According to the U.S. Bureau of Economic Analysis (BEA), the average machine in a U.S. manufacturing facility is nearly 9 years old. Perhaps it’s not surprising, then, that the No. 1 reason for investing in new equipment next year is to replace old or worn-out machinery. Indeed, more than half of assembly plants will replace aging machinery in 2021, marking the third straight year in which that figure has exceeded 50 percent.

The problem of aging equipment is particularly acute among manufacturers of appliances (67 percent) and fabricated metal products (65 percent). Those investment plans dovetail with BEA data, which show that machinery in appliance assembly plants averages 9 years old, while equipment in metal products plants averages 9.5 years old.

One appliance manufacturer that will be upgrading old equipment is GE Appliances. The company announced in July that it will invest $62 million in its sprawling Appliance Park assembly complex in Louisville, KY, creating 260 new jobs. A big part of the capital investment, $43 million, will go to transform the complex’s refrigeration manufacturing building to add a new line for a high-end, four-door refrigerator. Another $19 million of the investment will go to new equipment and upgrades for the park’s dishwasher line.

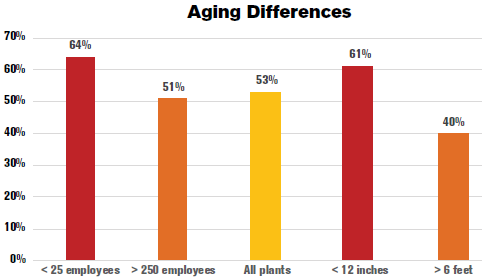

Given their smaller budgets, small companies are more apt to keep equipment longer than larger companies. As a result, small companies might have a more acute need to replace old machinery. According to our survey, 64 percent of manufacturers with 25 employees or less will replace old technology next year, compared with 51 percent of manufacturers with more than 250 employees.

Oddly, assemblers of small products are more likely than assemblers of large ones to replace old machinery. For example, 61 percent of assemblers of products less than 12 inches long are looking to replace aging equipment in 2021, compared with 40 percent of assemblers of products larger than 6 feet long.

Assemblers at Capacity

According to the Federal Reserve, U.S. durable goods manufacturers were running at 70.8 percent of capacity in October. That’s up from the pandemic low of 54 percent in April, but it’s down from 74.1 percent in October 2019.

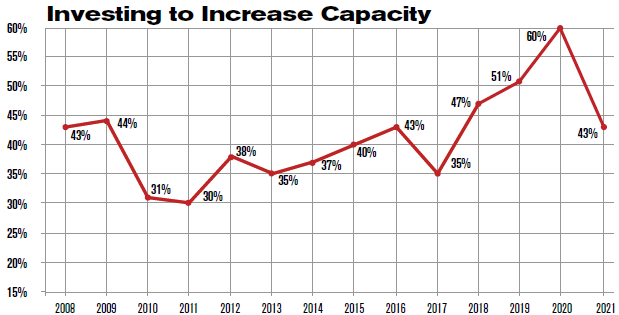

That inactivity is reflected in our survey data. Just 43 percent of assemblers are looking to increase capacity or output larger volumes of existing products in 2020. That compares with 60 percent in 2020, and it’s the lowest percentage since 2017.

Given the pandemic, it’s no surprise that medical device manufacturers lead all industries in seeking to add capacity next year. Some 56 percent of medical device assemblers—more than any other industry—want to boost capacity next year. It’s the third time in four years in which that percentage has exceeded 50 percent.

One medical device manufacturer that’s boosting capacity is B. Braun Medical Inc. In October, the company announced that it would soon begin full-scale production at its newly expanded assembly plant in Daytona Beach, FL. The company invested approximately $210 million to increase the size of the facility to 218,000 square feet and to install robotic equipment to produce IV bags. The expansion is expected to create at least 100 additional jobs.

In contrast, the aerospace industry is dealing with overcapacity, thanks to the pandemic. Only 36 percent of aerospace assemblers are looking to add capacity next year. Small wonder. The pandemic has virtually shut down air travel. The second quarter of 2020 was the worst financial hit in the history of the U.S. airline industry, and the third-quarter results won’t be much better. U.S. airlines reported combined losses of $12 billion in the second quarter, as revenue plunged 86 percent from the prior year. Analysts are forecasting that losses will come to about $10 billion in the just-completed third quarter.

With airlines having neither the cash nor the need for new airplanes, aerospace manufacturers are reeling. Boeing announced that it would be cutting 30,000 jobs by the end of next year. Raytheon Technologies is cutting 15,000 staff and 4,000 contractor positions, largely at the company’s Pratt & Whitney and Collins Aerospace divisions. GE Aviation cut its workforce by 10 percent and furloughed 50 percent of its remaining engine-making workers for four weeks.

Other Motives

Cost reduction is always an important motivation for investing in assembly technology, but manufacturers might be particularly worried about cost control next year. Fifty percent of assemblers will buy equipment next year to cut costs, the most in seven years.

Cost concerns are especially worrisome in the fabricated metal products industry, where 60 percent of plants will buy equipment next year to cut costs, the most of any industry. In fact, makers of faucets, hinges and other products have exceeded the national figure for cost-cutting for seven straight years.

Other motives for investing in assembly technology include:

- Forty-four percent will buy equipment to reduce cycle time or eliminate a bottleneck. This percentage has topped 40 percent for three straight years.

- Thirty-six percent of plants will buy equipment next year to assemble a new product. It’s the first time that this percentage has been below 40 percent since 2018.

- Twenty-nine percent will buy equipment to increase safety, which is slightly above average for our survey.

- Twenty-seven percent will buy equipment to implement lean manufacturing. This percentage is higher for aerospace manufacturers and, surprisingly, medical device manufacturers.

- Twenty percent will buy equipment in increase quality. This percentage has been 19 percent or more for four of the past five years.

- Eighteen percent will buy equipment to keep up with competition. Manufacturers in the fabricated metal products industry are nearly twice as likely as plants in other industries to be buying equipment for this reason.

- Thirteen percent will buy equipment to meet OEM or downstream

- requirements.

- Thirteen percent will buy equipment to comply with standards or industry regulations. Automotive and electronics assemblers are more likely than other manufacturers to be getting equipment for this reason.

Robots Top Shopping Lists

In terms of what assemblers will buy in 2021, demand for robots will continue to be strong. We expect sales of six-axis robots, SCARAs, grippers and other robotic technology to increase 14 percent, from $439.7 million in 2020 to $500 million in 2021.

Thirty-five percent of plants will purchase robots next year, virtually the same as the record-high of 36 percent in 2020. Demand for robots should be particularly strong in the medical, automotive and consumer products sectors.

“FANUC America is having a very good 2020 and expects this trend to continue in 2021,” says Scott Melton, FANUC’s general manager for authorized system integrators, education and regional sales. “Due to COVID-19, we have worked with numerous medical device and pharmaceutical companies to implement automation in the fight against the pandemic. We’ve also seen a significant increase in the use of robotic automation in the e-commerce and order fulfillment market to deliver the products people need for their homes. Many manufacturing and processing companies are implementing robots to allow for increased social distancing, while still achieving the production their clients demand. Also, as more companies reshore manufacturing, they are implementing robotic automation to be more competitive.”

“The first half of 2020 has been extremely challenging,” admits Nigel Smith, president of TM Robotics (Americas) Inc. “Companies were reluctant to invest, reducing capital expenditure and tightening their purse strings due to uncertainty in the market.

“However, since July, we’ve seen a positive upturn in enquiries. Automation is essential to compete in today’s manufacturing market—with or without COVID-19. Combined with a new need for physical distancing of employees in manufacturing facilities, robots are providing a solution for manufacturers to keep their operations going.”

One of the driving forces behind the spike in demand for robots has to be proliferation of collaborative robots. Indeed, 31 percent of assemblers are currently using the technology or plan to within the next year. An additional 17 percent expect to employ cobots within two to three years.

Melton says FANUC is getting a lot of interest in cobots. “We’re seeing a big demand for collaborative robots, primarily because they are easy to use—even for companies with no experience with robots,” he explains. “Cobots can be up and running right out of the box. When tasks change, cobots are so flexible they can be quickly redeployed, which is especially important today as the COVID situation rapidly evolves.”

Joe Campbell, senior manager for strategic marketing and application development at Universal Robots, agrees. “We expect sales of collaborative robots to continue to accelerate faster than sales of traditional robot technology,” he predicts. “The penetration of cobots in manufacturing remains very low—less than 100,000 total, against a total available market in the millions of units. We continue to see increased acceptance from companies large and small. In particular, small- and medium-sized enterprises have historically been underserved by traditional automation. Collaborative robots are dramatically changing that formula, with low installed costs, short lead-times and fast return on investment. We see this as a key growth area.”

Over the next three to four years, Campbell expects Universal’s sales to grow by 20 to 35 percent. “We are well-aligned to the long-term economic and technical trends in manufacturing, and we are continuing our investments in R&D, channel partners and programs," he says. "A good example is the expansion of our UR+ ecosystem to include higher order application kits. There are over 30 UR+ application kits, including our own ActiNav flexible machine loader. The UR+ program now has 288 approved kits and components, and dozens more are in the final testing phase.”

3D Printers and Other Tech

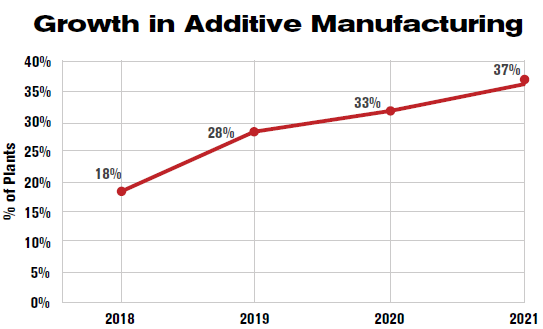

One of the biggest stories from this year’s survey is the increased demand for additive manufacturing. Demand for the technology has grown steadily during the past four years, and next year, 37 percent of plants—a record high—will invest in additive manufacturing equipment for metal and plastic parts. Almost half our respondents—45 percent—are currently using the technology or plan to within the next year.

Demand for 3D printers should be particularly strong in the aerospace, machinery and medical device manufacturing sectors. The technology also seems to be more the province of larger companies. Forty-two percent of plants with more than 100 employees will invest in the technology next year, compared with 30 percent of plants with less than 100 employees.

In all, assemblers will spend $150 million on additive manufacturing technology next year, an increase of 12 percent over 2020 sales.

“We are proud to say that in the first six months of 2020, we experienced double-digit growth year-over-year globally, including over 30 percent growth in the U.S. alone,” says Greg Elfering, head of the Americas for Ultimaker, a supplier of fused filament fabrication printers for plastic parts. “This was due, in part, to the disruption in manufacturing from the COVID-19 pandemic, resulting in a paradigm shift in the global supply chain. Localized manufacturing, reduced downtime and cost reduction have become priorities for manufacturers, which coincided with the heightened awareness of professional 3D printing and its impact on just-in-time part creation.

“For 2021 we foresee this trend continuing,” he adds. “The risks of disrupted supply chains are too high, especially in the midst of a pandemic, so there is greater need for local production. 3D printing can help manufacturers locally produce more spare and end-use parts than ever before.

“Manufacturers are now aware of the importance of a digital inventory, and companies are working on creating ‘digital warehouses’ in 2021 so parts can be printed on demand. Ultimaker offers everything they need to ensure the exact same part comes out of the 3D printer, no matter where you print it.”

Demand for single-station assembly machines should also be good next year. Some 49 percent of plants will buy presses, riveters and automatic screwdriving systems in 2021. It’s the fourth time in the past five years in which that percentage has been at or near 50 percent. Assemblers in the aerospace, automotive, appliance and fabricated metal products industries, in particular, will be shopping for single-station assembly machines.

All totaled, assemblers will spend $695.5 million on single-station assembly machines next year, a 5 percent increase from 2020.

“Overall, we experienced about a 15 percent drop off in business for the 2019-20 fiscal year, compared to the previous year,” notes Chuck Rupprecht, general manager of BalTec Corp., a supplier of presses and riveting machines. “The summer months were, in a word, slow. However, we saw a dramatic increase in overall activity and new orders in September and October.

“We are budgeting a very conservative forecast for the 2020-21 fiscal year, based on the unpredictable nature of things in the world today,” he adds. “I do see the automotive segment gaining some momentum. Hopefully, that will continue as we move into 2021. I’m cautiously optimistic that 2021 will at least be stable throughout the entire year. Hopefully, the worst is behind us with this pandemic now that a vaccine plan is starting to come into play. That, coupled with strong consumer demand for cars, housing, appliances and other goods, will assist our business model going forward.”

Previous

Capital Spending

Reports

2018

2017

2016

2015

2014

2013

2012

2011

Driven by strong demand from the medical device and consumer products industries, sales of multistation automated assembly systems should also increase next year. Twenty-four percent of plants will buy automated assembly lines in 2021. It’s the fifth time in the past six years in which that figure has topped 20 percent. In all, assemblers will spend $836.1 million on assembly systems next year, a 3 percent bump from 2020.

“We ended up with a good 2020, but we had lots of challenges,” notes Rick Blake, president of systems integrator Edgewater Automation. “We are looking forward to another good year in automaton sales in 2021. Most of that will come in U.S. sales, primarily in the life sciences space. Then again, Edgewater Automation has always been a bit more optimistic than some integrators. We see growth as part of who we are, so that might play into our forecast. Most of our customers are coming to us because they need a way to get their new products made.”

Not everything assemblers buy is as sophisticated as a robot or an automated assembly line. Indeed, 43 percent of plants will purchase workstations and ergonomic accessories next year, up from 40 percent in 2020. Driven by demand from the automotive and electronics industries, sales of workstations are expected to total $102 million next year, up from $100 million in 2020.

“We had moderate growth in 2020, but we are a new brand,” says Steven Wengerd, director of sales at Pioneer IWS, a manufacturer of weld tables, pack stations, shelving and other products. “We are projecting 40 percent growth in our IWS line of products. We are launching a new line of workbenches and pack stations to help justify this growth.”

combatting COVID

This year, manufacturers have been forced to consider an entirely new technology for their assembly lines: products to prevent the spread of COVID-19. Aside from masks and other personal protective gear, such products range from low-tech, such as custom protective barriers, to high-tech, such as personal RFID tags to facilitate contact tracing.

For example, 94 percent of assemblers have purchased cleaning and sanitizing stations for their lines. One such station was introduced earlier this year by Creform Corp. The simple mobile station holds cleaning supplies, hand sanitizer and postings about proper health practices and company procedures. It can hold supplies, such as gloves, wipes, cleaning solutions, towels, hand sanitizers and masks. The structure features a small table surface with a shelf located close to the base that can hold additional supplies and a refuse receptacle.

Other COVID-prevention products purchased this year include:

- Labels and signage to indicate proper social distancing and safety practices, 79 percent.

- Fever monitoring equipment to screen workers and visitors, 66 percent.

- Custom protective barriers or curtains, 55 percent.

- Air purification systems, 29 percent.

- Personal proximity sensors to maintain safe distancing between workers, 10 percent.

- Personal RFID tags to facilitate contact tracing, 8 percent.

Survey Methodology

ASSEMBLY magazine is sent to 54,001 assembly professionals in more than 33,000 locations.

The survey was conducted in conjunction with Clear Seas Research, an affiliate of BNP Media, ASSEMBLY magazine’s parent company. Clear Seas is a full service, B-to-B market research company. Custom research products include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

Questionnaires were e-mailed in mid-August to a random sample of 20,386 subscribers in management positions. Forty-one percent of respondents were engineers; 52 percent were management; and 7 percent were classified as “other.”

The cutoff date for returning the surveys was Sept. 2. Some 225 surveys were returned for a response rate of 1 percent.

The survey was sent to manufacturers in the following industries: aerospace, electronics, appliances, fabricated metal products, furniture, machinery, medical devices, plastics and rubber products, automotive, energy and miscellaneous manufacturing.

Geographically, 14 percent of respondents were located in the Northeast, 53 percent were in the Midwest, 20 percent were in the South, and 14 percent were in the West.

Fifteen percent of respondents had 25 employees or less. In addition, 21 percent had 26 to 100 employees, 10 percent had 101 to 250 employees, and 54 percent had more than 250 employees.

Twenty-three percent of respondents assemble products that can fit inside a 12-inch cube, 17 percent make products that can fit inside a 24-inch cube, 14 percent make products that fit inside a 36-inch cube, 21 percent make products that fit inside a 6-foot cube, and 25 percent make products that are larger than a 6-foot cube.

To purchase and download the entire capital spending report, please visit https://clearseasresearch.com. You can also email info@clearmarkettrends.com with any questions.